Technical Weekly 29052006

EQUITIES

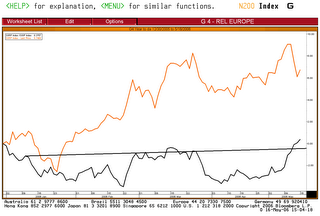

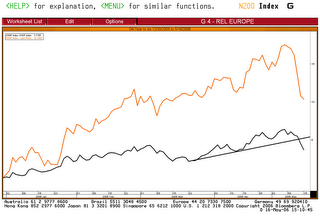

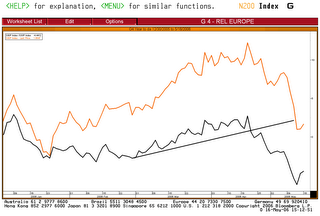

Last week I said that : “the Euro-Stoxx 50 has reached its 200-day moving average and potential chart support and that may be enough to cause a market rebound this week.”

The rebound is happening now but the market won’t just bounce off a “V” bottom and return to the bullish way because from a longer- term view, major technical and emotional (psychological) damage has been done.

For the last six months, any modest decline resulting in a slight oversold condition was fuel for the 'buy the dip' crowd to take prices strongly higher again. That is no longer the case.

The graph below shows the Euro Stoxx 50 rebounding on the 200 moving average with low volume, which is generally not a good sign.

COMMODITIES

Brent

The long-term uptrend for the Brent is still intact and the short- term consolidation favours further strength because the Macd indicator (see graph below) is now close to gives a short term buy signal.

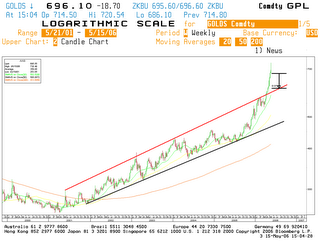

Gold

Further consolidation around 650$ is expected.

A break below that level could imply a deeper correction to the 600$ level.

GERMAN 10 YEAR YIELD

The short-term recovery continued for bonds and a retest of the 3.77% level seems likely.(see arrow on chart)

However on a long-term basis the downtrend still trend prevails for bonds.

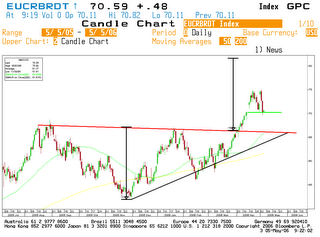

EURO-DOLLAR

As long as support at 1.2520 holds, the outlook would remain higher towards a test of 1.30.

A move back below 1.2520 would negate this bullish view, and suggest a test of the long term support line which currently lies at 1.2100.