Technical Weekly 15052006

EQUITIES

The technical short-term outlook is now bearish.

In the US for instance, there has been no 9% correction for 1,181 days, we are in the second years of the 4-year Presidential cycle and most of the technical indicators I follow gave recently sell signals on a weekly and daily basis.

However I would be excessively bearish on the major indices unless some of the major support areas are broken: 1285 for the SPX 500 and 3600 for the Euro Stoxx 50.(see graph. below)If those supports hold in the coming weeks, I expect this market to trade in a range.

COMMODITIES

Brent

The small bearish pattern could still be activated if the brent closes below the 70$ level.

If this event happens, this will be probably not the beginning of a significant bearish reversal but just a minor pullback.

Only a breakdown below 63$ would modify my view.

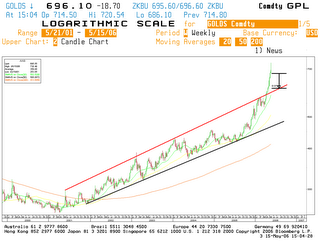

Gold

Last week, I wrote that the trend of gold was turning parabolic and that a correction was coming.

This is now happening and I advice not to buy before a successful test of rising channel.(still 10% correction possible!)

GERMAN 10 YEAR YIELD

In the US, the benchmark 10-year Treasury note finished the week down with a yield hitting another four-year high of 5.189 percent.

I still think that a correction may start soon before yields rise again.

The monthly graphic below shows the German government bonds 10 year yield in a rising trend since October 2005 challenging an important downtrend line around 4.3%.

EURO-DOLLAR

After the recent strong performance the rate is now overbought and a pause is expected in the coming days.

I don’t forecast a major bearish reversal and on the contrary the rate could reach the 1.3 levels in the coming weeks.

Aucun commentaire:

Enregistrer un commentaire