vendredi, juin 27, 2008

mercredi, juin 25, 2008

US Bank index

The BKX bank index in the U.S. tested long-term support at 60 and will likely attempt to hold that level over the near term given that the index is very oversold and down approximately 30% over the past two months.

Publié par

HEIREBAUDT FREDERIC

à

2:15 PM

0

commentaires

![]()

Libellés : INDICES

mardi, juin 17, 2008

Sensex

How do me know when the trend has changed?

I use a simple method : the 1,2,3 trend reversal.

On this long term weekly chart of the Sensex (India) we can clearly see that the uptrend line was broken in March 2008.

This was the first part of the method.

The second part of this method is the pull-back and the lower high happening in May.

Part 3 which complete the reversal pattern is a lower low.

For this we have to wait for an eventual break below the support zone (dot red line).

Publié par

HEIREBAUDT FREDERIC

à

2:18 PM

0

commentaires

![]()

Libellés : INDICES

mercredi, juin 11, 2008

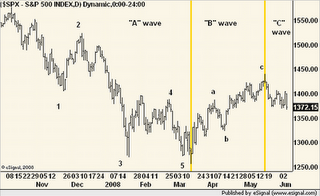

Elliott waves bear market potential target

"click on the chart to enlarge"

This was the first leg of the correction.

What we saw from January through May was the "B" wave higher, which essentially corrected the first correction.

As you can see the impulse waves, (decline from October) unfolded in five wave and the rally through May was arguably three waves.

That leaves us with the current decline now just getting underway.

The "C" wave is usually as long as A, but may often be 1.62 x A.

So the downside target of this bear market for the SP 500 could be between 1130 and 1075.

This last number corresponds to the bottom of the wave 4 of the last bull market.(horizontal line on the long term chart above)

Publié par

HEIREBAUDT FREDERIC

à

2:09 PM

4

commentaires

![]()

Libellés : INDICES

vendredi, juin 06, 2008

€/$

The rate rebounds strongly at the support zone around 1.54.

Publié par

HEIREBAUDT FREDERIC

à

1:13 PM

1 commentaires

![]()

Libellés : DEVISES

jeudi, juin 05, 2008

Buy&Sell DJ Euro Stoxx 50 and Dow jones Industrials

Publié par

HEIREBAUDT FREDERIC

à

4:28 PM

0

commentaires

![]()

Libellés : SIGNAUX

lundi, juin 02, 2008

Commodities bubble?

The first chart is a long term relative chart of the CRB index versus the SP500.

The second one compares the materials sector weight as a percent of the SP 500.Looking at these two charts I do not see a bubble.

On the contrary I'm still long term bull.

The last chart compares the financials sector weight as a percent of the SP 500 : this is not a great chart!

Publié par

HEIREBAUDT FREDERIC

à

11:54 AM

0

commentaires

![]()

Libellés : SECTEURS

Sector relative strength

Each chart, rising (falling) lines indicate periods where the sector is outperforming (underperforming) the Stoxx 600.

While the economy remains weak, sectors that typically benefit from a weak economy have not been acting particularly well.

Recent action in the Food&beverage, Health Care and Telecoms sectors has been very poor.

I have started to see renewed interest for defensive sectors since last week and it may be time to favoring Food&beverage and Telecoms sectors after their strong decline.

It's not just defensive sectors that have been presting badly .

Financials and Technos remain in a pronounced downtrend.

Utilities continue to run into resistance at current levels.

Finally, Materials and Oil&Gas continue to trade in nice uptrends.

Although both of these sectors are trading at the upper end of the range, any weakness in them as they approach resistance is likely to be temporary.

Publié par

HEIREBAUDT FREDERIC

à

8:37 AM

0

commentaires

![]()

Libellés : SECTEURS