jeudi, mai 31, 2007

BUY&SELL DJ EURO STOXX 50

Publié par

HEIREBAUDT FREDERIC

à

1:47 PM

0

commentaires

![]()

Libellés : SIGNAUX

vendredi, mai 25, 2007

Technical Weekly 25052007

Last week I said that the market was overbought but that the trend was still good.

Now I think that the risk of a correction has risen.

Arrows (TD sequential and combo indicators) on the chart of the DJ Euro Stoxx 50 are signaling that the market is risky and that a bearish reversal may happen soon. We see the same story when we look at other indices.The chart of the MSCI World since the beginning of the year for instance is also showing “sell arrows”.

So for conclusion, we can say that equity markets are at risk and quite mature but keep in mind that (as we said last week) the trend is still ok and buyers are still buying the dips when a correction occurs.

On the weekly chart, the German bond yield is approaching the first target at 4.5% where some profit taking may happen.

But momentum is still rising and the yield has recently broken above an ascending triangle bullish pattern.

On the last weekly I said that if the Brent was able to break above the 70$ level, this could open the door towards the 78$, which is the top of the trend channel.

No change. The Euro is still in the process of correcting its long term rise, which means that a deeper pull-back towards the major support line (red line on the chart) is a strong probability.

The first minor support is 1.33 (red dot line).

The long term trend is still up for the Euro.

Publié par

HEIREBAUDT FREDERIC

à

11:12 AM

4

commentaires

![]()

Libellés : TECHNICAL WEEKLY

jeudi, mai 24, 2007

TELECOM

There is a lot of interest for telcos stocks.On the chart below, you can see that the DJ Stoxx Telecom index rises above a symmetrical triangle on strong volumes.

Publié par

HEIREBAUDT FREDERIC

à

12:21 PM

0

commentaires

![]()

Libellés : SECTEURS

OIL

The Brent validates a bullish signal today.

This confirm that oil is now back in the uptrend channel.

The target is the top of the channel around 78-80$

Publié par

HEIREBAUDT FREDERIC

à

10:51 AM

0

commentaires

![]()

Libellés : MATIERES PREMIERES

CHINA

Shanghai composite is very close to long term major resistance.

Publié par

HEIREBAUDT FREDERIC

à

9:19 AM

0

commentaires

![]()

Libellés : INDICES

mercredi, mai 23, 2007

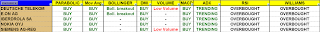

Stocks with best upside potential

While some technical indicators are warning of a possible correction, the global equity market has continued to move higher aided by an avalanche of liquid public savings moving into stocks.

So in this condition it is very important to find stocks with favorable risk reward ratio.

In the scan below ( only members of the Stoxx 600) using updata we are identifying 3 key ingredients:

1 – Upside Targets from Buying Thrust where the Target is at least 3 times further from the price than the stop.

2 – That the stock is in an uptrend so that we are taking signals with trend

3 – That the target is at least 10% away

Here are the big names : ADIDAS AKZO DIOR ENEL RECKITT REED SAFRAN SCHNEIDER SOLARWORLD PEUGEOT

By the way my 10 stocks equity portfolio(only big cap) is up +15.09% since the beginning of the year.

The current names are :CMB IBA URANIUM PARTICIPATION EDF ENERGIES NOUVELLES NEXANS RHODIA TECHNIP VALLOUREC ABENGOA and a equity fund on the AUSTRALIAN market.

I'm watching closely SOLARWORLD and some telcos stocks for a future switch in the porfolio.

Publié par

HEIREBAUDT FREDERIC

à

2:07 PM

0

commentaires

![]()

Libellés : SIGNAUX

lundi, mai 21, 2007

NOKIA

The long term chart of NOKIA looks pretty good to me.

The flat base pattern is one of my favorite long term pattern and usually this move signals a profond change in trend.

Price moves horizontally for months, making peaks and valleys as price moves forward, but hitting a generally flat top, flat bottom or both.

Once price closes above this top, it has pierced overhead resistance and is free to move up.

That is exactely what is happening for NOKIA now.

Publié par

HEIREBAUDT FREDERIC

à

4:04 PM

0

commentaires

![]()

Libellés : SIGNAUX

Technical Weekly 21052007

Equities

65% of the members of the DJ Euro Stoxx50 are trading above the 20 day moving average, 76% above the 50, 77% above the 100 and 90% above the 200.

This means that the index remains in a clear uptrend.

On the other way, indicators (see table below) are still giving a mixed picture and the market is entering a flat seasonal period between May and October.

You can also see that the RSI is close to be overbought again, but for now

I will respect and continue to ride the trend.

I stay with an overweight equity exposure but will be vigilant in the coming weeks. If the market turns parabolic, I will not hesitate to sell and take some profits.

A simple line chart of the generic bund future with two moving averages (50 in green and 200 in yellow) shows that bonds are now in a bear market.

Last week I said that the German bond yield was forming a bullish flag continuation pattern.

So, I keep my targets of 4.5% and may be 4.85% for the coming weeks/months.

The Brent is now facing resistance at the 70$ level.

The stochastics indicator is still rising but is now overbought.

A break above this level would open the door towards the 78$, which is the top of the trend channel.

Strong support is located around the 60$ level.

The rate is now trading below the 1.35 level, which means that a deeper pull-back towards the major support line (red line on the chart) is a strong probability.

The first minor support is 1.33 (red dot line).

The long term trend is still up for the Euro.

Publié par

HEIREBAUDT FREDERIC

à

2:19 PM

0

commentaires

![]()

Libellés : TECHNICAL WEEKLY

lundi, mai 14, 2007

Technical Weekly 11052007

This technical breakdown is bearish in the short-term as it confirms the sell signals validated by most daily technical indicators.

On the chart, you can see that there is a short-term risk is of seeing a more significant correction towards the 4170 level (4% downside risk) and may be towards the lower trend-line of the uptrend channel .(7% downside risk)

For now, I expect just a pullback rather than the start of a major trend reversal.

Bonds

No change, the German bond yield is still forming a bullish flag, which means that we keep our targets of 4.5% and may be 4.85% for the coming weeks/months.

On a short term basis the trend is neutral.

Publié par

HEIREBAUDT FREDERIC

à

8:07 AM

0

commentaires

![]()

Libellés : TECHNICAL WEEKLY

lundi, mai 07, 2007

AAII:BULL-BEAR

Individual investors in the US are bearish and they do not believe that the recent rally is "for real".

Publié par

HEIREBAUDT FREDERIC

à

1:28 PM

0

commentaires

![]()

Libellés : SENTIMENT

vendredi, mai 04, 2007

Technical Weekly 04052007

Equities

Sellers tried to put some pressure on the equity markets but as you can see on the hourly chart of the DJ Euro Stoxx 50, the trend is still positive.

Most technical indicators are overbought and are turning negative but as long as the support is holding, I'm not turning bearish.

For instance, the chart of UCB recently turns bullish and technically speaking the stock may reach 50 EUR in the coming weeks.

Strong support exists around the 13.700 level.

What is worrying to us is that this index was leading in Europe and that the pattern could be big bearish double top with a target around 12450.(+/-14% decline)

I think that the German 10 Year yield will continue to consolidate between the 4.1 and 4.25% level in the coming days.

Because of overbought status the yield needs a rest but I still expect another rise to the 4.5% level in the mid-term and may be to the 4.85% level which is the target of the ascending triangle.

Still trading up, a rebound on the lower trend-line channel (in green on the chart) could be the trigger for a rise towards the upper trend-line channel.

On the other way a break below the 65$ could jeopardize the bullish trend with a downside risk around 60$.

In the last weekly I said that my first target of 1.36 was already reached and that I do not believe that the next target (1.38) will be reached immediately because technical indicators were very overbought.

Now we can see that the MACD indicator (lower panel) is bearish which means that the pull-back is already occurring.

The first support is located around 1.35.

Publié par

HEIREBAUDT FREDERIC

à

11:14 AM

0

commentaires

![]()

Libellés : TECHNICAL WEEKLY

jeudi, mai 03, 2007

IBEX

Spain (IBEX) recently gave a technical sell signal.

Strong support exists around the 13.700 level.

What is worrying to me is that this index was leading in Europe and that the pattern could be a big bearish double top with a theorical objectif around 12450.(+/-14% decline)

Publié par

HEIREBAUDT FREDERIC

à

11:41 AM

0

commentaires

![]()

Libellés : INDICES