Technical Weekly 08052006

EQUITIES

As expected, equity markets rebound from oversold conditions.

The long- term bull trend is intact but the sharp rise of the Euro-dollar and the persistent rising yields could push pressure on equities in the coming weeks.The chart below of the DJ Euro Stoxx 50 is already showing some sign of weakness as the weekly Macd indicator turns recently bearish.

COMMODITIES

Brent

My target remains in the 84-85$ zone in the coming weeks and I do not believe that the recent decline last week is the start of major correction.

However, on a short term basis a small bearish double top may be forming.

Gold

The uptrend of gold is now turning parabolic.

This advance will be hard to sustain and I believe that a correction is coming soon.Each time the Td combo indicator gave a sell signal (see arrows on the weekly chart) the price of gold strongly moved back.

GERMAN 10 YEAR YIELD

Yields are now overbought and may start a short-term correction soon.

The TD combo indicator sell signal on the weekly chart reinforces this probability (see arrows).However my technical target in the coming weeks remains 4.5%.

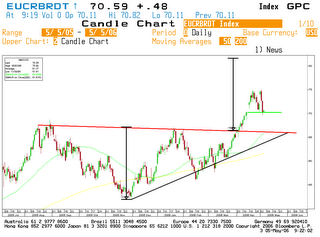

EURO-DOLLAR

Easily exceeded my short-term target and accelerated sharply last week.The rate could reach the strong 1.3 resistance zone in the coming weeks and the target of the right angle broadening bottom pattern (historically 89% of successful formations) is 1.34.

Aucun commentaire:

Enregistrer un commentaire