Technical Weekly 08082006

EQUITIES

On the chart below of the DJ Euro Stoxx 50, the bulls assert that the index validated a reverse head & shoulder pattern with a target of around 3950 and the bears noticed a recent bearish crossover between the 50 and 200-day MAs (death cross).For now, it is too early to say that we are going to have an additional down leg which will take out the June low but the fact that money is flowing into defensive stocks in general and to safer large cap stocks at the expense of riskier smaller stocks, convince me to keep a risk averse strategy so as to be in a position to take advantage of bargain values that can be expected in the autumn.

COMMODITIES

Brent

Recently breaking above a symmetrical triangle and getting close to the 84$ target zone.

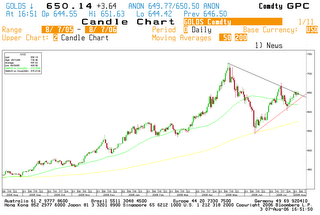

Gold

The long-term uptrend remains intact but the short-term trend is neutral (triangle pattern).

GERMAN 10 YEAR YIELD

The U.S. economy added fewer jobs than expected during July and the unemployment report rose for the first time in five months to 4.8% from 4.6%.

The weak job report is the latest in a string of signs that the economy is weakening.

That is usually good news for bond prices, which do better in a slowing economy.

Technically, this is a logical spot for bond prices to start doing better and bond yields (which move in the opposite direction) to start dropping.

The monthly chart of the 10-year German yield shows the price testing a major down- trend-line connecting the highs of 1990, 1994, 2002 and 2006.

This place would be a logical spot for bond yields to start to weaken.

And that is what they have been doing recently.In the US, the 10-year yield has fallen below its June low to the lowest level in four months and in the Euro zone the 4.9% support level for the German 10 year yield is an important support to watch.

EURO-DOLLAR

The euro remains trapped in a long-term uptrend.As long as the long -term support line (in red) currently at 1.25 continues to hold, the outlook would remain higher with 1.30 as next resistance and 1.34 as next target.

Aucun commentaire:

Enregistrer un commentaire