Technical weekly 29102007

Equities

After a typical short term-pullback, equity markets rebound strongly on support zone.(arrow on the chart of the DJ Euro Stoxx 50)

Overall this event confirms our mid-term bullish view and we believe technical conditions are still healhty.

Moreover the seasonal trends are turning bullish for the end of the year.

It is important to keep in mind that this a mature bull market and that market breadth indicators have been lagging prices since the start of the recent recovery.

Signs of selectivity is seeing everywhere and we continue to favour :

-big caps over small caps

-growth over value

-telecoms, basic resources, oil&gas sectors over banks, real estate and Health care sectors.

So for now the correction observed this summer did not jeopardise the mid-term bull trend and we do not think it will before year end, even if new pullbacks occur

Bonds

No change, as long as the long- term support rising trendline is not broken we do not favor more downside.

Yields may continue to trade sideways in the coming days/weeks.

No change, as long as the long- term support rising trendline is not broken we do not favor more downside.

Yields may continue to trade sideways in the coming days/weeks.

Bloomberg’s bond yield forecast.

Brent

The Brent validates a bullish breakout from a triangle pattern above an important resistance.The first target (according to fibonacci extension) was already reached last week. The next one around 94$( this is also target of the triangle pattern) could be reached in the coming weeks.

The Brent validates a bullish breakout from a triangle pattern above an important resistance.The first target (according to fibonacci extension) was already reached last week. The next one around 94$( this is also target of the triangle pattern) could be reached in the coming weeks.

The chart below shows our long term projection target of 150$ for the Brent for the beginning of 2009.

Euro

Reaching our target of 1.44.The uptrend still prevails but profit taking is expected in the coming days

Reaching our target of 1.44.The uptrend still prevails but profit taking is expected in the coming days

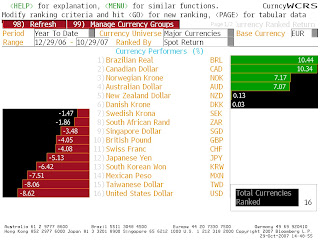

Major currencies ranked returns versus € (year to date)

Aucun commentaire:

Enregistrer un commentaire