Technical Weekly 26092006

EQUITIES

Equity indices give not clear directional indications at least on a short- term basis.

The recent weakness still falls within the category of a consolidation and should be traded as such until short-term support is broken.

A break above new highs could prove that momentums are stronger than previously expected and the risk of a blow-off pattern (the peaking of stock prices after a lengthy advance and heavy trading) is rising.

On a mid-term basis I continue to believe that markets are trading in the late stages of their summer recovery and I stick to our cautious stance.

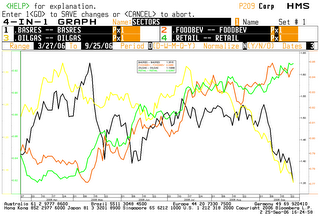

The main topic in the market remains sector rotation and the continued sell-off in commodity sectors.

The chart below compares on a relative basis the falling basic resources (black line) and Oil&Gas sectors (yellow line) with the rising retail (green line) and food&beverage (red line) sectors.

COMMODITIES

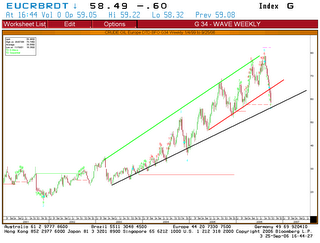

Brent

Oil is now extremely oversold on a daily basis and I think it is not the time to be outright bearish on Brent.The mid –term trend is now down since August but on the weekly chart below, we can see that the 60-58 zone should provide support.

Gold

No change from last week the ounce may continue to weaken towards the support zone around 550$ in the near term.

A break below this zone will trigger an important long- term sell signal validating a double top bearish pattern.

GERMAN 10 YEAR YIELD

Breaking down from the strong support at 3.7%, it would need to sustain a close above this level to offset potential for additional downside.

Technically this looks like a big top pattern for yields, meaning that I'm now bullish for bonds.The target of the pattern is located around the 3.35%.

EURO-DOLLAR

The euro should stay above support at 1.27 in order to keep the immediate outlook bullish with 1.30 as next target level.

A break above this level would be very positive because the rate would validate a bullish ascending triangle.

Below 1.27 on the other hand, the downward risk would further extend to 1.25.

Aucun commentaire:

Enregistrer un commentaire