Technical Weekly 270106

EQUITIES

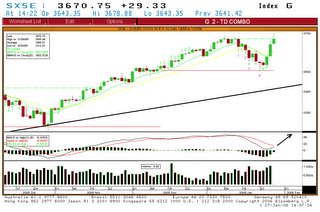

After a correction nearly to the 3500 support level the Euro Stoxx 50 rebounds quickly and I believe that it is likely to move higher.

The bounce was pretty impressive and other markets also experienced strong days on rising volume.

Japan for instance have bounced right off the 50 days moving average, that suggests that the worse may be over in the land of the rising sun.So, for now, the trend is up. Especially outside US and it is only if the SP 500 breaks below 1250 that I may worry a bit.

COMMODITIES

Brent

I remain bullish even after the significant downside move of last week.

As you can see on the chart, the trend is still up for the Brent.

Only a break below the mid-term uptrend (in red) will change my view.

Gold

The trend of gold remains very strong.A pullback due to extreme overbought situation is likely (see arrows on the chart when a pink 13 number appears a correction is likely) but the long term remains bullish.

GERMAN 10 YEAR YIELD

Bonds are more cause for concern than equities because the significant upside acceleration on yields last week confirm my bearish scenario and I believe that there is a high probability of further upside towards 3.7%.(arrow on chart)

EURO-DOLLAR

No change from last week as the Euro-dollar has been stabilising.

The low point touched corresponds to a 38.2% retracement of the bullish movement started at the beginning of 2002.(see graph below)

I still think that the rate will break above 1.22 but on a short- term basis it could consolidate between 1.196 and 1.21.

1 commentaire:

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Enregistrer un commentaire