mardi, juillet 31, 2007

lundi, juillet 30, 2007

Bearish trend?

If the market doesn’t bounce soon (Monday or Tuesday) and the support lines break down for all the indices, then look out as we may be in a seriously bearish trend.

The 200 day moving average is the last defense.(green line)

But as the VIX spikes on Friday, I favor a rebound in the coming days.

Publié par

HEIREBAUDT FREDERIC

à

8:42 AM

0

commentaires

![]()

Libellés : INDICES

mercredi, juillet 25, 2007

BREAKDOWN!

members of the DJ Euro STOXX 50 : a lot of short term breakdowns.

members of the DJ Euro STOXX 50 : a lot of short term breakdowns.

Publié par

HEIREBAUDT FREDERIC

à

3:25 PM

0

commentaires

![]()

Libellés : SIGNAUX

A TOP IN JUNE PART 4

Back to business!

I showed you some charts of the STOXX and the Dj Euro Stoxx50 based on Fibonacci sequence.

Elliott wave analysis with a regression line + 2 std deviations (here is the last one)

Now this is a quick update but this time it is a daily chart (zoom).

We can see that the DJ Euro Stoxx 50 was not able to reach new highs and that it recently broken down below an important support.(small triple tops)

I'm not excessively bearish because for now this is just part of a normal correction and not a major reversal.

BUT A BREAK BELOW THE RISING LOWER UPTRENDLINE (ARROW) WILL CHANGE MY VIEW.(+/-3% downside potential left)

MY FIRST IMPRESSION IS THAT I THINK IT IS TOO SOON TO ACCUMULATE STOCKS.

Publié par

HEIREBAUDT FREDERIC

à

2:48 PM

0

commentaires

![]()

Libellés : INDICES

mercredi, juillet 04, 2007

HOLIDAYS

Publié par

HEIREBAUDT FREDERIC

à

2:59 PM

0

commentaires

![]()

Libellés : LIENS/ARTICLES

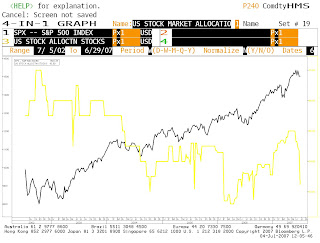

US STRATEGISTS

Bloomberg's recent strategist survey showed a (strong) decrease in the recommended allocation for stocks.

As you can see on the charts during the last 5 years there is (often) an inverse correlation between the SP500 and the % stocks recommended.

Publié par

HEIREBAUDT FREDERIC

à

12:13 PM

0

commentaires

![]()

Libellés : SENTIMENT

lundi, juillet 02, 2007

Short term bullish

Just as it looked like the major averages were ready to break the downside (double tops), the buy-the-dips mentality came back in force.

On a short term basis the DJ Euro STOXX 50 made a morning star bullish pattern (circle).

As sentiment is still showing fears (volatiliy is rising and us investors are very bearish) in the short term the risk of a fall is decreasing and

in the same time the probability of the rise continuing is increasing.

Publié par

HEIREBAUDT FREDERIC

à

4:55 PM

1 commentaires

![]()

Libellés : INDICES

VERY BULLISH CALL ON ENERGY STOCKS

Today the DJ Oil&Gas index validates a long term bullish breakout.As you can see the target is more than 15% higher.

Publié par

HEIREBAUDT FREDERIC

à

2:16 PM

0

commentaires

![]()

Libellés : SIGNAUX