Technical Weekly 28062006

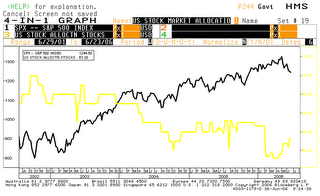

EQUITIES

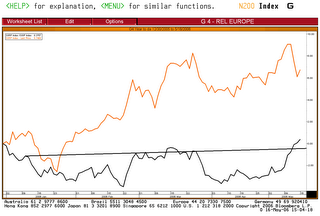

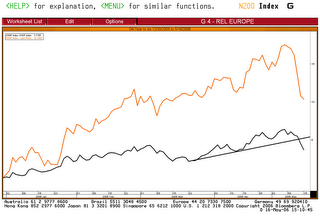

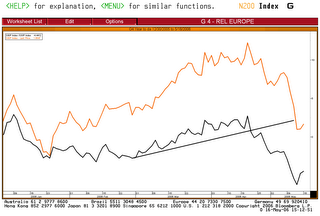

Equity markets rebound from oversold condition but technically speaking,

any rally attempt in the major indices should now be capped by strong resistances.

I still recommend a defensive posture and think that another down leg could be coming soon.

The chart below shows the DJ Euro Stoxx 50 trading below the 200 (yellow) and 50 day (green) moving averages, the bearish signal will be totally confirmed when the 50 day falls below the 200 day.

In conclusion, the massive oversold conditions that we saw in the last two weeks resulted only in a classic sharp, but I think, short-lived “V rally”.

If the index were to clearly close above 3600 then I expected to see this rally go to the 3750 resistance zone, but I still think that the bearish trend will reassert itself later.

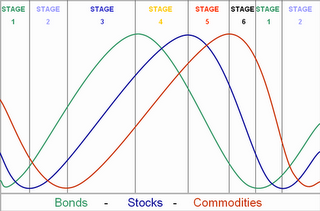

COMMODITIES

Brent

Accelerates sharply up in the last few days and is now trying to break above the April high around 75$.

A break above the symmetrical triangle would be very bullish.

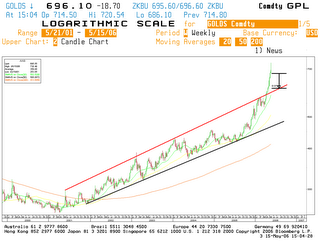

Gold

The support zone around 550$ was able to stop the decline.We believe that a stabilization process at this level may occur in the coming weeks before gold may try to resume his long-term uptrend.

GERMAN 10 YEAR YIELD

Is now close to resistance around 4.1%.A break above this level implies that there is a risk of seeing yields trading around 4.5% in the coming months.

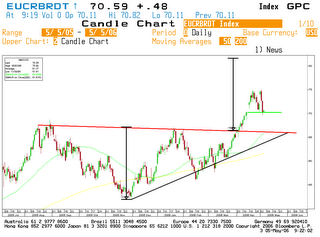

EURO-DOLLAR

Close to support zone around 1.25.(red line)

On the weekly chart, you can see that as long as support around 1.25 holds, the outlook would remain higher towards a test of 1.30, which is a strong resistance.