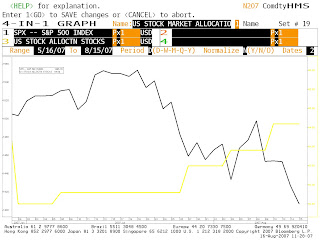

Smart&dumb money

The 2 charts below show the trend of the smart money (black line) and the trend of the dumb money (yellow line-small traders) for the SP 500.(traders commitment)

On the first one you can see that the smart money became short in mid 2000.

In the second one you can see that the smart money were selling equities since end September 07 and became short recently.